Featured

Table of Contents

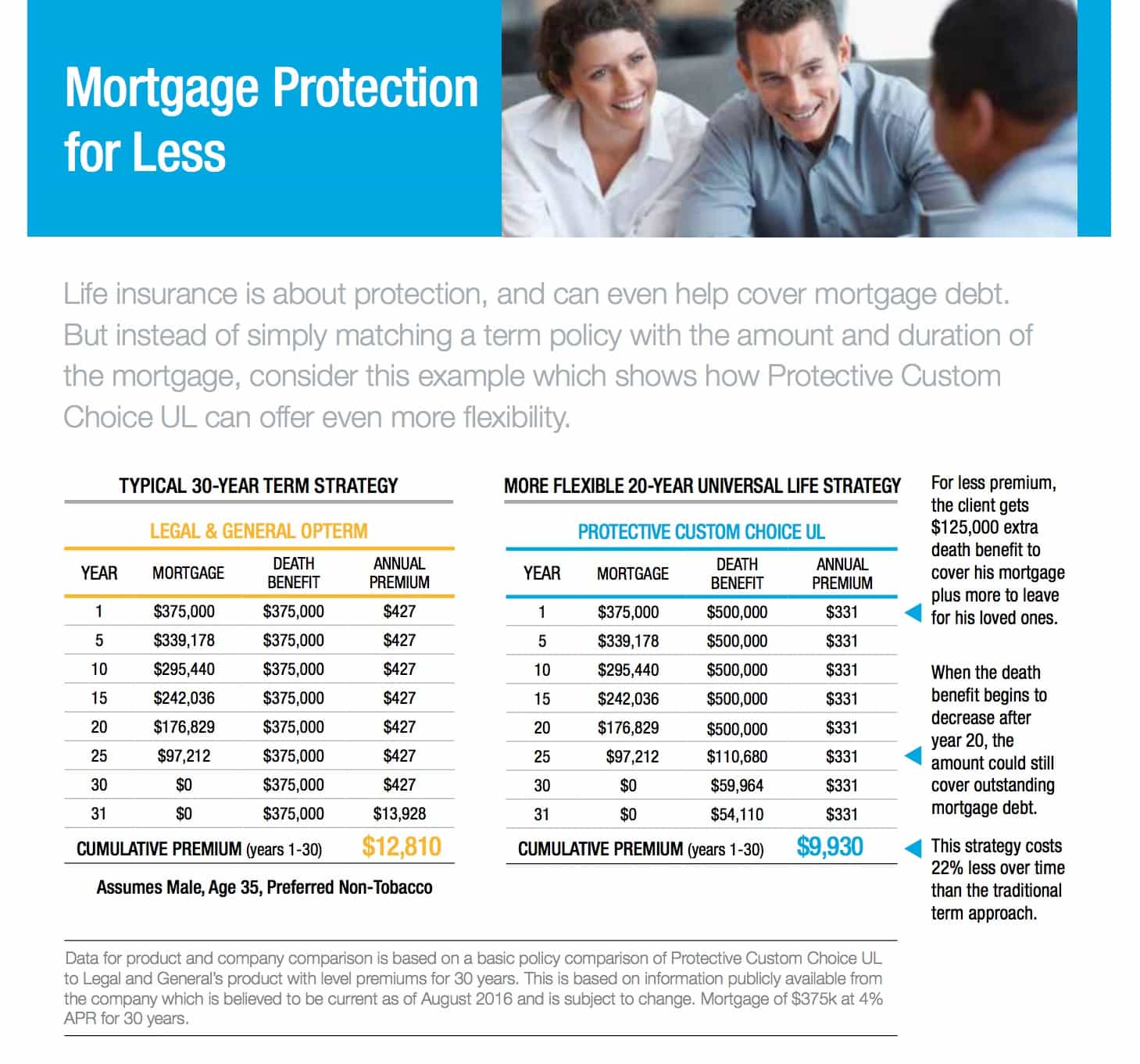

Keeping all of these phrases and insurance types straight can be a headache. The following table puts them side-by-side so you can swiftly differentiate amongst them if you obtain confused. One more insurance policy protection type that can settle your home mortgage if you die is a conventional life insurance plan

A is in place for an established number of years, such as 10, 20 or 30 years, and pays your recipients if you were to pass away during that term. An offers coverage for your whole life span and pays out when you pass away.

One typical guideline of thumb is to go for a life insurance policy that will certainly pay out up to 10 times the policyholder's wage quantity. You may select to use something like the Penny approach, which adds a family's financial debt, earnings, home loan and education and learning expenditures to compute exactly how much life insurance policy is needed.

It's also worth keeping in mind that there are age-related limits and limits imposed by virtually all insurance providers, who frequently won't provide older purchasers as several options, will certainly bill them more or might deny them outright.

Right here's how mortgage security insurance measures up versus conventional life insurance policy. If you're able to certify for term life insurance coverage, you must prevent home mortgage defense insurance (MPI).

In those circumstances, MPI can provide wonderful satisfaction. Simply be sure to comparison-shop and check out every one of the fine print prior to signing up for any type of plan. Every home mortgage protection choice will have countless guidelines, guidelines, advantage options and disadvantages that require to be considered meticulously versus your exact situation (state regulated mortgage protection plan).

Mortgage Protection Insurance Premium

A life insurance plan can help repay your home's mortgage if you were to pass away. It is just one of several ways that life insurance coverage may help protect your enjoyed ones and their economic future. Among the very best means to factor your mortgage right into your life insurance requirement is to chat with your insurance policy agent.

As opposed to a one-size-fits-all life insurance coverage policy, American Household Life Insurance policy Firm supplies policies that can be created particularly to fulfill your family's demands. Below are several of your options: A term life insurance coverage plan. find mortgage insurance is active for a particular amount of time and generally supplies a bigger quantity of protection at a reduced price than an irreversible policy

A whole life insurance policy plan is just what it seems like. As opposed to only covering a set number of years, it can cover you for your whole life. It likewise has living benefits, such as cash worth build-up. * American Domesticity Insurer supplies various life insurance policy policies. Speak to your agent concerning tailoring a policy or a combination of plans today and getting the satisfaction you are entitled to.

They may additionally be able to aid you find gaps in your life insurance coverage or new ways to conserve on your other insurance plans. A life insurance beneficiary can select to make use of the fatality advantage for anything.

Life insurance policy is one method of helping your family members in paying off a home loan if you were to pass away prior to the mortgage is entirely paid off. Life insurance policy earnings might be used to help pay off a mortgage, but it is not the exact same as home loan insurance policy that you could be needed to have as a condition of a loan.

Mortgage Payment Protection Insurance Ireland

Life insurance coverage may aid ensure your residence remains in your family by providing a fatality advantage that may aid pay down a home loan or make important acquisitions if you were to pass away. This is a short summary of insurance coverage and is subject to policy and/or motorcyclist terms and problems, which might vary by state.

The words life time, long-lasting and irreversible undergo policy terms. * Any financings extracted from your life insurance coverage plan will build up passion. insurance to pay off mortgage after death. Any kind of outstanding lending equilibrium (funding plus passion) will be subtracted from the fatality advantage at the time of insurance claim or from the cash value at the time of abandonment

** Topic to plan conditions. ***Discounts might differ by state and firm underwriting the vehicle or property owners plan. Price cuts may not relate to all insurance coverages on an automobile or house owners plan. Price cuts do not put on the life plan. Plan Kinds: ICC18-33 (10 ), ICC18-33 (15 ), ICC18-34 (20 ), ICC18-35 (30 ), L-33 (10 )(ND), L-33 (15 )(ND), L-34 (20 )(ND), L-35 (30 )(ND), L-33 (10 )(SD), L-33 (15 )(SD), L-34 (20 )(SD), L-35 (30 )(SD), ICC18-36 (10 ), ICC18-36 (15 ), ICC18-36 (20 ), ICC18-36 (30 ), L-36 (10 )(ND), L-36 (15 )(ND), L-36 (20 )(ND), L-36 (30 )(ND), L-36 (10 )(SD), L-36 (15 )(SD), L-36 (20 )(SD), L-36 (30 )(SD), ICC17-225 WL, L-225 (ND) WL, L-225 WL, ICC17-227 WL, L-227 (ND) WL, L-227 WL, ICC17-223 WL, L-223 (ND) WL, L-223 WL, ICC17-224 WL, L-224 (ND) WL, L-224 WL, ICC17-228 WL, L-228 (ND) WL, L-228 WL, ICC21, L141, MS 01 22, L141, ND 02 22, L141, SD 02 22.

Home mortgage defense insurance (MPI) is a different kind of safeguard that can be practical if you're unable to settle your home loan. Home mortgage protection insurance coverage is an insurance coverage plan that pays off the remainder of your home mortgage if you pass away or if you end up being disabled and can't function.

Like PMI, MIP secures the lender, not you. Unlike PMI, you'll pay MIP for the period of the loan term. Both PMI and MIP are called for insurance protections. An MPI policy is entirely optional. The quantity you'll pay for home mortgage protection insurance coverage relies on a range of factors, consisting of the insurance company and the existing balance of your home mortgage.

Still, there are advantages and disadvantages: Most MPI plans are provided on a "assured acceptance" basis. That can be beneficial if you have a health and wellness condition and pay high rates forever insurance policy or struggle to obtain protection. life and disability insurance for mortgage. An MPI policy can supply you and your household with a feeling of safety

Mortgage Life Cover With Critical Illness

It can also be handy for individuals that do not get or can't pay for a standard life insurance plan. You can select whether you require mortgage protection insurance coverage and for for how long you require it. The terms normally range from 10 to 30 years. You could desire your home mortgage defense insurance policy term to be enclose size to for how long you have entrusted to settle your home mortgage You can cancel a home mortgage defense insurance plan.

Table of Contents

Latest Posts

Burial Insurance Costs

Starting A Funeral Insurance Company

Final Expense Brokers

More

Latest Posts

Burial Insurance Costs

Starting A Funeral Insurance Company

Final Expense Brokers