Featured

Table of Contents

Nevertheless, maintaining every one of these acronyms and insurance coverage kinds straight can be a migraine - allstate mortgage disability insurance. The following table places them side-by-side so you can promptly distinguish among them if you obtain puzzled. One more insurance policy coverage kind that can pay off your mortgage if you die is a typical life insurance coverage policy

A is in location for an established number of years, such as 10, 20 or 30 years, and pays your beneficiaries if you were to pass away during that term. A provides protection for your whole life span and pays out when you pass away.

One usual guideline of thumb is to intend for a life insurance coverage policy that will pay out as much as 10 times the insurance policy holder's wage quantity. You could select to utilize something like the Dollar technique, which includes a household's debt, earnings, home mortgage and education costs to determine exactly how much life insurance policy is needed.

It's additionally worth noting that there are age-related restrictions and limits enforced by virtually all insurers, that frequently won't give older buyers as numerous options, will certainly charge them more or might refute them outright.

Right here's exactly how mortgage defense insurance policy measures up against basic life insurance coverage. If you're able to certify for term life insurance coverage, you ought to prevent home loan protection insurance coverage (MPI).

In those circumstances, MPI can supply fantastic peace of mind. Every home loan defense option will have countless policies, regulations, benefit choices and downsides that need to be considered meticulously against your accurate situation.

Life Insurance For Property

A life insurance policy policy can assist pay off your home's home mortgage if you were to pass away. It is just one of numerous manner ins which life insurance might help protect your enjoyed ones and their economic future. One of the best ways to factor your home loan into your life insurance coverage need is to chat with your insurance agent.

Rather than a one-size-fits-all life insurance policy plan, American Family members Life Insurance provider supplies policies that can be made specifically to fulfill your household's demands. Below are some of your alternatives: A term life insurance coverage policy. mpi insurance coverage is energetic for a details quantity of time and normally uses a bigger quantity of insurance coverage at a lower rate than a long-term plan

Rather than only covering an established number of years, it can cover you for your whole life. It additionally has living benefits, such as cash money worth buildup. * American Family Members Life Insurance Company provides various life insurance policy policies.

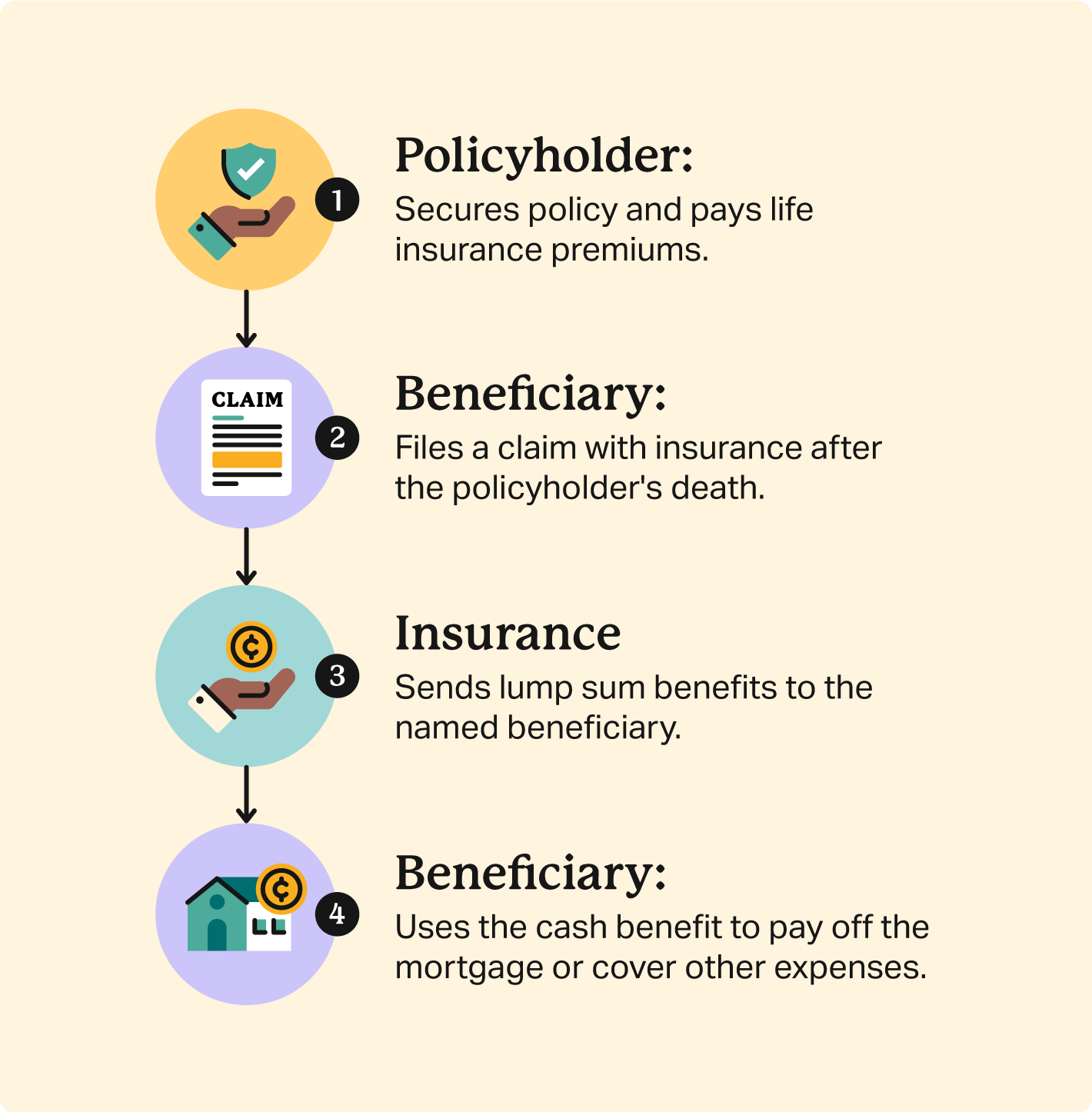

Your agent is a wonderful resource to answer your inquiries. They may likewise be able to aid you locate voids in your life insurance policy coverage or brand-new methods to reduce your various other insurance policy plans. ***Yes. A life insurance policy beneficiary can select to make use of the survivor benefit for anything - mortgage insurance and life insurance. It's a great method to assist secure the financial future of your family members if you were to pass away.

Life insurance coverage is one method of aiding your family in paying off a mortgage if you were to pass away before the mortgage is completely paid back. Life insurance policy earnings might be utilized to help pay off a home loan, however it is not the very same as home loan insurance coverage that you might be needed to have as a problem of a financing.

Buy Insurance Mortgage

Life insurance coverage may aid ensure your residence stays in your household by providing a death benefit that might help pay down a mortgage or make essential purchases if you were to pass away. This is a brief description of insurance coverage and is subject to plan and/or cyclist terms and conditions, which may vary by state.

Words life time, long-lasting and permanent are subject to plan conditions. * Any fundings drawn from your life insurance policy will certainly accumulate interest. mortgage loan policy. Any type of outstanding car loan balance (financing plus passion) will be deducted from the survivor benefit at the time of claim or from the cash worth at the time of abandonment

Discounts do not apply to the life plan. Policy Forms: ICC18-33 (10 ), ICC18-33 (15 ), ICC18-34 (20 ), ICC18-35 (30 ), L-33 (10 )(ND), L-33 (15 )(ND), L-34 (20 )(ND), L-35 (30 )(ND), L-33 (10 )(SD), L-33 (15 )(SD), L-34 (20 )(SD), L-35 (30 )(SD), ICC18-36 (10 ), ICC18-36 (15 ), ICC18-36 (20 ), ICC18-36 (30 ), L-36 (10 )(ND), L-36 (15 )(ND), L-36 (20 )(ND), L-36 (30 )(ND), L-36 (10 )(SD), L-36 (15 )(SD), L-36 (20 )(SD), L-36 (30 )(SD), ICC17-225 WL, L-225 (ND) WL, L-225 WL, ICC17-227 WL, L-227 (ND) WL, L-227 WL, ICC17-223 WL, L-223 (ND) WL, L-223 WL, ICC17-224 WL, L-224 (ND) WL, L-224 WL, ICC17-228 WL, L-228 (ND) WL, L-228 WL, ICC21, L141, MS 01 22, L141, ND 02 22, L141, SD 02 22.

Mortgage security insurance coverage (MPI) is a different sort of secure that could be useful if you're incapable to repay your home loan. While that additional defense sounds great, MPI isn't for every person. Here's when mortgage defense insurance deserves it. Home loan defense insurance is an insurance plan that settles the remainder of your mortgage if you pass away or if you end up being disabled and can't function.

Both PMI and MIP are called for insurance coverages. The amount you'll pay for home mortgage security insurance depends on a range of elements, including the insurance company and the existing equilibrium of your mortgage.

Still, there are benefits and drawbacks: A lot of MPI policies are provided on a "ensured approval" basis. That can be useful if you have a health and wellness condition and pay high prices for life insurance or battle to acquire protection. how to get mortgage insurance. An MPI plan can supply you and your family with a sense of protection

Supplemental Mortgage Insurance

You can pick whether you need home loan security insurance policy and for just how lengthy you need it. You could desire your home mortgage protection insurance policy term to be close in length to just how long you have left to pay off your home mortgage You can terminate a home loan protection insurance plan.

Table of Contents

Latest Posts

Burial Insurance Costs

Starting A Funeral Insurance Company

Final Expense Brokers

More

Latest Posts

Burial Insurance Costs

Starting A Funeral Insurance Company

Final Expense Brokers