Featured

Table of Contents

- – What is 20-year Level Term Life Insurance? How...

- – Key Features of Annual Renewable Term Life Ins...

- – What is Life Insurance Level Term and Why Doe...

- – How Does Level Premium Term Life Insurance Pr...

- – What is Term Life Insurance With Accelerated...

- – What is the Difference with Level Premium Te...

- – What Is What Is Level Term Life Insurance Co...

With this type of degree term insurance coverage, you pay the exact same monthly premium, and your beneficiary or recipients would receive the very same benefit in case of your fatality, for the whole protection period of the policy. How does life insurance job in terms of expense? The expense of level term life insurance coverage will certainly depend upon your age and health and wellness in addition to the term size and insurance coverage amount you pick.

Life: AgeGenderFace AmountTerm LengthPremium30Male$500,00030$29.9930 Lady$1,000,00030$43.3135 Male$500,00020$20.7235 Woman$750,00020$23.1340 Man$600,00015$22.8440 Lady$800,00015$27.72 Price quote based upon rates for eligible Place Simple candidates in excellent health. Pricing distinctions will certainly vary based upon ages, wellness condition, protection quantity and term length. Place Simple is currently not offered in DE, ND, NY, and SD. No matter what coverage you select, what the plan's cash money worth is, or what the swelling amount of the survivor benefit ends up being, satisfaction is among one of the most useful benefits related to acquiring a life insurance coverage plan.

Why would someone pick a policy with an each year renewable premium? It may be a choice to think about for a person that requires insurance coverage only momentarily. An individual who is in between work however desires death benefit protection in place due to the fact that he or she has financial debt or other financial responsibilities might wish to take into consideration an annually sustainable plan or something to hold them over till they begin a brand-new task that offers life insurance.

What is 20-year Level Term Life Insurance? How It Works and Why It Matters?

You can generally renew the policy annually which offers you time to consider your alternatives if you want coverage for longer. Realize that those alternatives will entail paying more than you made use of to. As you get older, life insurance policy costs end up being considerably extra expensive. That's why it's handy to purchase the right amount and size of coverage when you initially obtain life insurance policy, so you can have a reduced price while you're young and healthy.

If you contribute crucial overdue labor to the family, such as childcare, ask yourself what it might cost to cover that caretaking work if you were no longer there. Make certain you have that protection in place so that your family obtains the life insurance benefit that they need.

Key Features of Annual Renewable Term Life Insurance Explained

For that established amount of time, as long as you pay your costs, your price is secure and your beneficiaries are safeguarded. Does that mean you should constantly select a 30-year term length? Not always. As a whole, a much shorter term plan has a reduced costs rate than a much longer plan, so it's smart to pick a term based upon the forecasted length of your monetary responsibilities.

These are all crucial factors to bear in mind if you were thinking of picking a permanent life insurance such as a whole life insurance policy plan. Lots of life insurance coverage policies give you the alternative to include life insurance policy motorcyclists, think added benefits, to your plan. Some life insurance policy plans come with bikers built-in to the cost of costs, or bikers might be readily available at a cost, or have actually fees when worked out.

What is Life Insurance Level Term and Why Does It Matter?

With term life insurance policy, the communication that the majority of people have with their life insurance policy business is a month-to-month expense for 10 to 30 years. You pay your regular monthly costs and hope your family will never need to utilize it. For the group at Haven Life, that appeared like a missed chance.

We think browsing choices about life insurance policy, your individual financial resources and general wellness can be refreshingly simple (20-year level term life insurance). Our content is developed for academic purposes only. Place Life does not recommend the business, products, solutions or approaches reviewed right here, however we hope they can make your life a little less hard if they are a fit for your situation

This product is not meant to give, and should not be depended on for tax, lawful, or investment recommendations. People are motivated to seed guidance from their own tax or legal counsel. Find Out More Sanctuary Term is a Term Life Insurance Policy Plan (DTC and ICC17DTC in certain states, including NC) issued by Massachusetts Mutual Life Insurance Policy Firm (MassMutual), Springfield, MA 01111-0001 and provided specifically via Haven Life Insurance Company, LLC.

Finest Business as A++ (Superior; Top category of 15). The rating is as of Aril 1, 2020 and goes through change. MassMutual has gotten various rankings from various other ranking companies. Sanctuary Life Plus (And Also) is the advertising name for the And also motorcyclist, which is included as component of the Haven Term plan and provides accessibility to additional services and benefits at no price or at a price cut.

How Does Level Premium Term Life Insurance Protect Your Loved Ones?

If you depend on someone monetarily, you could ask yourself if they have a life insurance policy. Find out exactly how to locate out.newsletter-msg-success,.

When you're more youthful, term life insurance policy can be a straightforward means to shield your liked ones. As life adjustments your monetary concerns can as well, so you might desire to have whole life insurance policy for its life time protection and additional benefits that you can utilize while you're living. That's where a term conversion can be found in.

What is Term Life Insurance With Accelerated Death Benefit? Detailed Insights?

Approval is assured no matter your health. The costs won't increase as soon as they're set, yet they will certainly go up with age, so it's a good idea to lock them in early. Figure out much more concerning exactly how a term conversion functions.

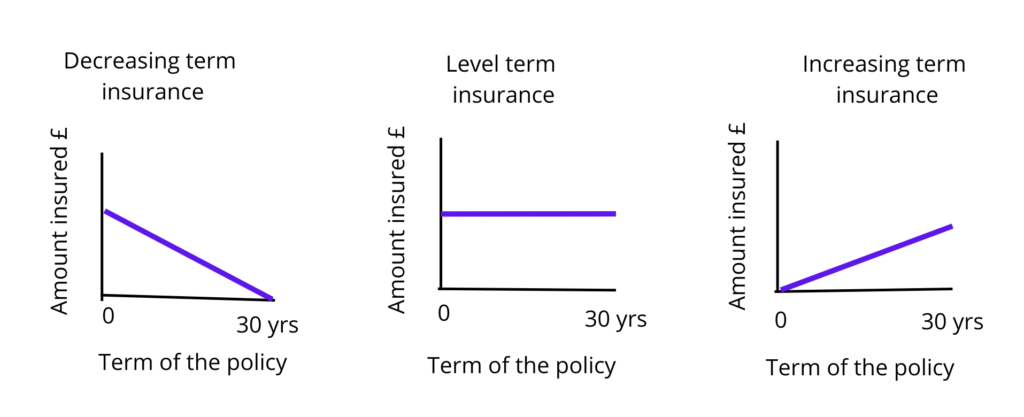

Words "level" in the expression "degree term insurance" implies that this kind of insurance coverage has a set premium and face amount (fatality advantage) throughout the life of the plan. Just placed, when people speak about term life insurance coverage, they usually refer to level term life insurance. For the bulk of individuals, it is the simplest and most cost effective option of all life insurance policy types.

What is the Difference with Level Premium Term Life Insurance Policies?

The word "term" here describes a given number of years during which the degree term life insurance policy stays active. Degree term life insurance policy is among the most prominent life insurance coverage policies that life insurance policy providers use to their customers as a result of its simplicity and affordability. It is also very easy to contrast degree term life insurance coverage quotes and get the ideal premiums.

The mechanism is as complies with: Firstly, pick a plan, survivor benefit amount and plan period (or term length). Select to pay on either a monthly or yearly basis. If your premature death occurs within the life of the plan, your life insurance company will pay a round figure of fatality benefit to your predetermined beneficiaries.

What Is What Is Level Term Life Insurance Coverage and How Does It Work?

Your level term life insurance policy runs out once you come to the end of your policy's term. Alternative B: Get a brand-new level term life insurance policy.

2 Expense of insurance prices are figured out utilizing methodologies that differ by company. It's vital to look at all elements when examining the overall competitiveness of rates and the value of life insurance protection.

Table of Contents

- – What is 20-year Level Term Life Insurance? How...

- – Key Features of Annual Renewable Term Life Ins...

- – What is Life Insurance Level Term and Why Doe...

- – How Does Level Premium Term Life Insurance Pr...

- – What is Term Life Insurance With Accelerated...

- – What is the Difference with Level Premium Te...

- – What Is What Is Level Term Life Insurance Co...

Latest Posts

Burial Insurance Costs

Starting A Funeral Insurance Company

Final Expense Brokers

More

Latest Posts

Burial Insurance Costs

Starting A Funeral Insurance Company

Final Expense Brokers